Home /

Money Blog

Evaluating a refinance offer

Note: You can use any financial calculator to do this problem, but if you want the BEST, you can

get our

10bii

Financial Calculator for iOS, Android, Mac, and Windows!

THE SCENARIO

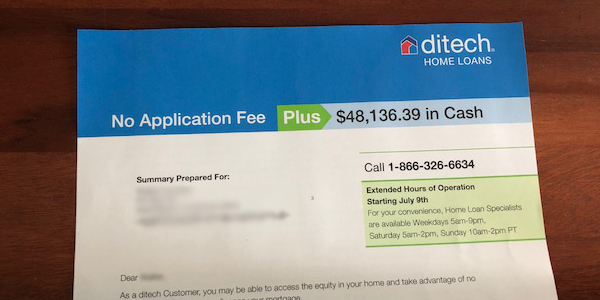

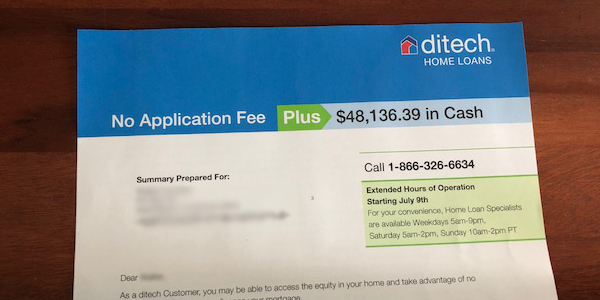

I recently got a letter from Ditech Home Loans, offering to refinance a property for me. My initial assumption is that it would be the condo in which I live, but they never state that and the numbers in the letter don't match my primary residence

at all. There's plenty of boilerplate in the letter which makes me think that if I were to contact them to take them up on the offer, they'd reject me (after sending

me the letter), but since they don't state the borrowing rate on the mailer, I figured it'd be good to discover what it is. My intuition says that when a lender isn't up-front with their rates, those rates are probably pretty bad… but who knows, maybe I'll be pleasantly surprised.

The question: They're offering a 30-year fully amortizing loan in the amount of $92,338.00 (with a loan-to-value ratio of 76.31%*). The monthly payment would be $495.70. So what's the interest rate of this loan?

* If 76.31% of the value is $92,338.00, then the full value must be $92,338 / 76.31% = $121,003.80, which narrows down which property they might be talking about, since they didn't state it in their letter.

THE SOLUTION

This one is pretty straightforward.

First things first, make sure the calculator is using 12 Payments per Year.

N: 360 (It's a 30-year loan)

I/YR: (This is what I'm trying to find)

PV: $92,338 (They're seeking to lend me $92,338.00)

PMT: -495.70 (The monthly payment on the loan would be $495.70)

FV: 0 (It's a fully amortizing loan)

Though they didn't state it, I can surmise that the interest rate of the loan is 5.00%.

The offer is definitely for a primary residence (it states as much in the fine print of the letter), and the valuation of the property I figured out above definitely tells me that this offer is for a property that I don't live in. Still, if they're lending money to owner-occupants at 5%, maybe they'll lend on an investment property at a higher (but still manageable) rate. It might be worth giving them a call to find out.

What do you think? Do you think you could get a good refinance offer through unsolicited mail? Or do you figure they're all scams? Let us know in the comments!