Home /

Money Blog

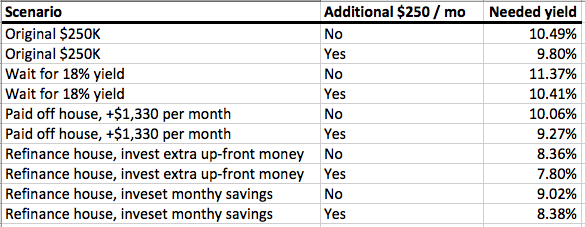

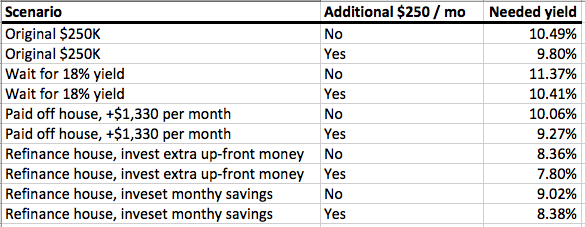

What yield do I need? Summary

Note: You can use any financial calculator to do this problem, but if you want the BEST, you can

get our

10bii

Financial Calculator for iOS, Android, Mac, and Windows!

THE SCENARIO

John and Jane Smith are 53 years old, and hope to retire at 65. They have $250,000 currently sitting in a bond fund, earning them 2.8% per year. Their house will be paid off in 12 years, which will free up their current $1,330 mortgage payment (but not the taxes and insurance that they pay each month for their house). Of the $191,000 they originally borrowed, they still owe $97,500.(7% borrowing rate)

They've calculated that they'll need $875,000 in investments to retire after 12 years. Evaluating a variety of options, here's what the Smiths have discovered.

THE SOLUTIONS

- If they invest their $250,000 for 12 years, they need to earn 10.49% on their money.

- If they invest their $250,000 for 12 years, and add $250 per month, they need to earn 9.8% on their money.

- If they invest their $250,000 at 2.8% for 2 years, then at 18% for 1 year, they need to earn 11.37% for the remaining 9 years.

- If they invest their $250,000 at 2.8% for 2 years, then at 18% for 1 year, they need to earn 10.41% for the remaining 9 years, if they add $250 per month to their investment.

- If they paid off their house immediately and invested the remaining $152,500 and $1,330 per month, they need to earn 10.06% on their money.

- If they paid off their house immediately and invested the remaining $152,500 and $1,330 plus an additional $250 per month, they need to earn 9.25% on their money.

- If they refinanced their house, kept the payment the same but borrowed additional money, and invested the resulting $338,544.55 for 12 years, they need to earn 8.36% on their money.

- If they refinanced their house, kept the payment the same but borrowed additional money, and invested the resulting $338,544.55, plus an additional $250, per month for 12 years, they need to earn 7.80% on their money.

- If they refinanced their house, kept the balance the same, and invested the payment difference of $633 per month for 12 years, they need to earn 9.02% on their money.

- If they refinanced their house, kept the balance the same, and invested the payment difference of $633, plus an additional $250, per month for 12 years, they need to earn 8.38% on their money.

Here's a chart that summarizes these results: