Home /

Money Blog

Not a Loan But We'll Give You Money

Note: You can use any financial calculator to do this problem, but if you want the BEST, you can

get our

10bii

Financial Calculator for iOS, Android, Mac, and Windows!

Photo by Kyle Humfeld

THE SCENARIO

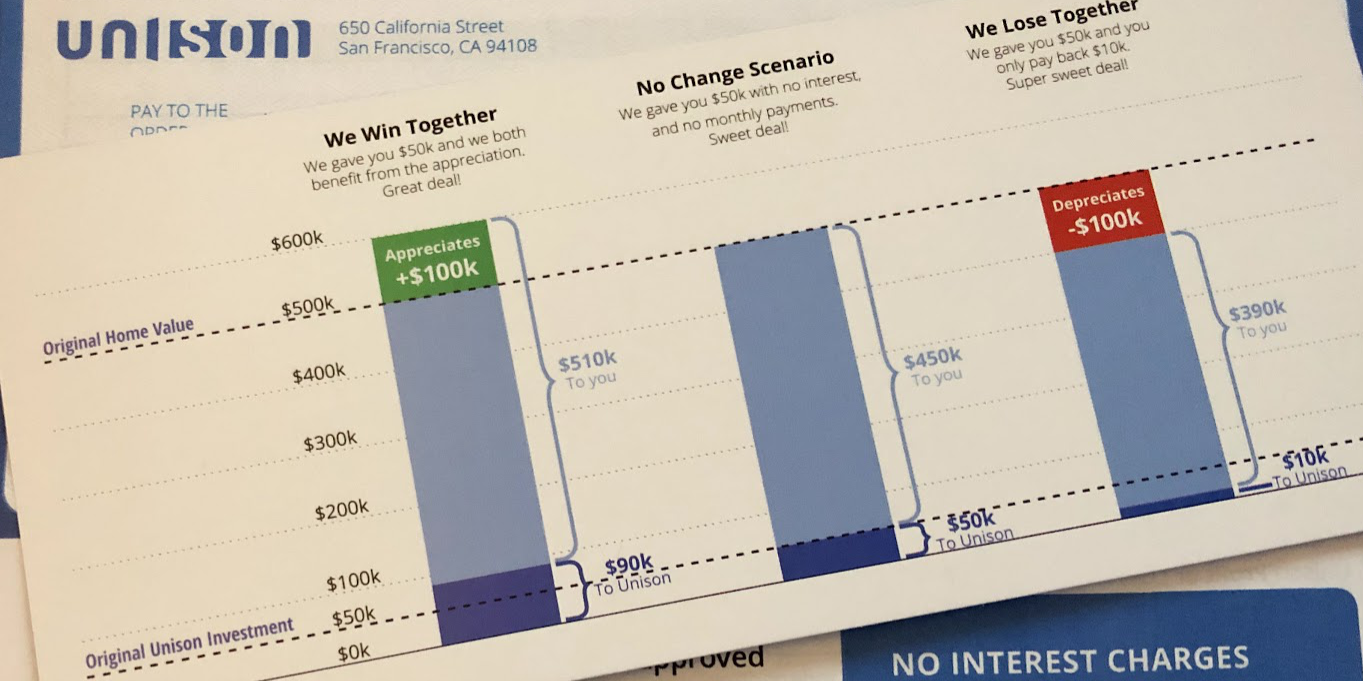

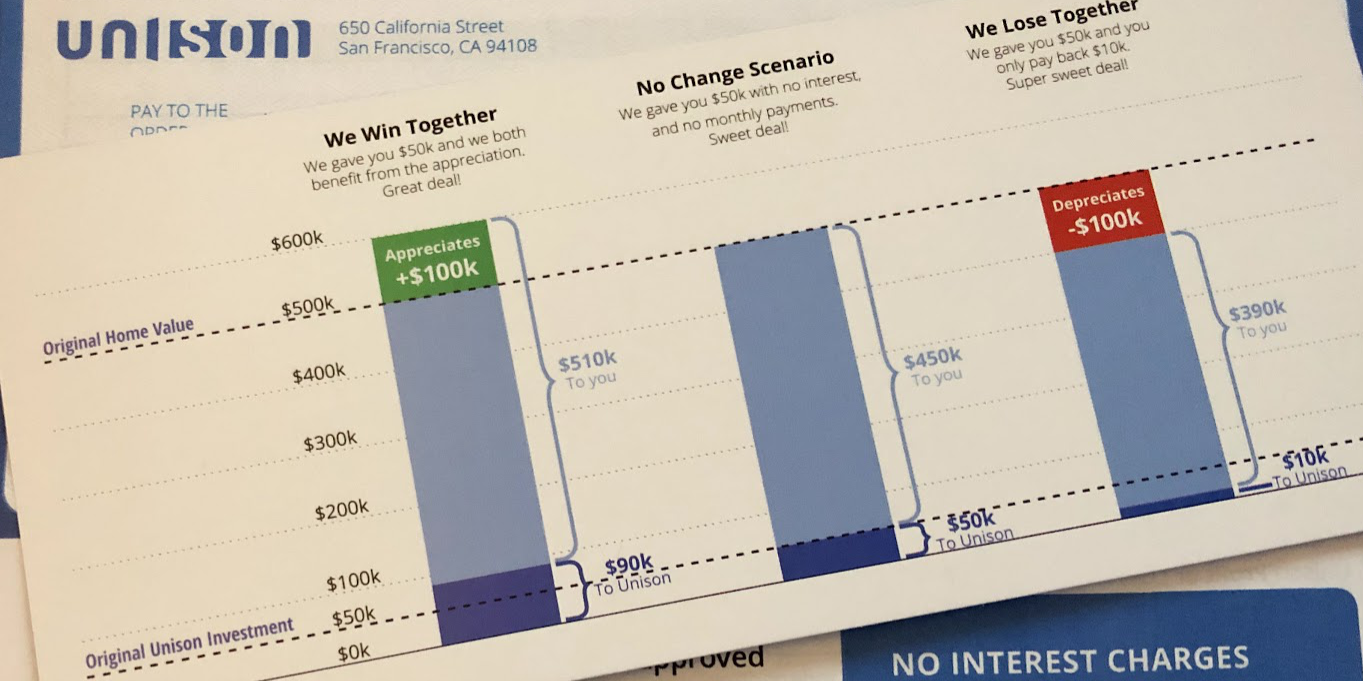

I get home equity loan offers in the mail all the time, but this week I got something a little different. Namely, rather than lending me money which is secured against my condo, 'Unison' wants to send me money to buy some of the future appreciation in my condo. When I sell, we figure out how much my condo has appreciated, and then they get back the money they gave me plus 40% of the increase in value (from today, not from the day I bought it). If the condo has depreciated, then I have to pay them back less than the amount they gave me (40% of the decrease in value). If it doesn't go up or down, I just give them back the money they gave me. They'll give me up to 20% of the value of my condo.

The question: If my condo appreciates 5% per year for the next 10 years and then I sell it, what is Unison's ROI (annualized percentage)? Assume that my condo is worth $500,000 right now and that I take as much from them as they'll give me (20%). Also assume that it costs me nothing to sell my condo, and that appreciation compounds monthly.

THE SOLUTION

This one has several parts, but most of them are pretty simple.

- Find out how much Unison gives me today.

- Find out how much I'll sell my condo for in 10 years.

- Find out how much I'll owe Unison when I sell.

- Find out Unison's ROI.

First things first, make sure the calculator is using 12 Payments per Year.

Step 1: What do I get from Unison?

Today, I get 20% of the current value of my condo from Unison. That amounts to $500,000 x 20% =

$100,000.

Step 2: How much does my condo sell for?

N: 120 (I'll sell my condo in 10 years, which is 10 x 12 = 120 months)

I/YR: 5 (My condo appreciates 5% per year)

PV: -500,000 (My condo is currently worth $500,000)

PMT: 0 (Appreciation doesn't have money flowing in or out monthly)

FV: (This is what I'm trying to find)

In 10 years, my condo will be worth $823,504.75.

Step 3: How much do I owe Unison?

When I sell, I'll owe Unison their original $100,000,

plus 40% of the appreciation.

The appreciation is the final $823,504.75 minus the original $500,000, which is $823,504.75 - $500,000 = $323,504.75.

40% of the appreciation is $323,504.75 x 40% = $129,401.90.

So I have to give Unison $100,000 + $129,401.90 =

$229,401.90.

Step 4: What's Unison's ROI?

N: 120 (Unison has their money invested in my property for the same 10 years, which is 120 months)

I/YR: (This is what I'm trying to find)

PV: -100,000 (Unison originally invests $100,000)

PMT: 0 (Unison neither pays nor receives any money in the meantime)

FV: 229,401.90 (At the end, I pay Unison $229,401.90)

Unison makes 8.33% on their investment.

If Unison has money they don't need for a long time, this might be a relatively safe way for them to make it grow at a reasonably healthy rate. I say relatively safe because it's possible they'll lose money... but only if I sell the property after it's gone down in value, which I would definitely try to avoid doing (nobody likes to lose money, myself included).

What do you think? Should I take Unison up on their kind offer? Would you? Why or why not? Let us know in the comments!