Home /

Money Blog

Gold! The best investment! Or is it?

Note: You can use any financial calculator to do this problem, but if you want the BEST, you can

get our

10bii

Financial Calculator for iOS, Android, Mac, and Windows!

THE SCENARIO

THE SCENARIO

If you've been [literally anywhere], you've no doubt run across people claiming that gold is the best investment, that the US Dollar (or most other currencies you could name) is a 'fiat currency', and that ever since the US fully went off the Gold Standard in 1971*, our money's been worthless because it's not backed by a metal you have to dig out of the ground... but that metal has

real, intrinsic, inherent value.**

But let's say that you had the foresight to buy an ounce of gold long ago, and you wanted to sell it today. How good would your return be?

A quick Internet search

reveals that on March 13th 1975, gold was selling for $178.00 per ounce. I was just about to be born at the time, so let's say that my parents bought me an ounce of gold to make me rich when I got older.

On May 14th 2017, it was going for $1,228.60.

If we use monthly compounding, what's your return on investment if you bought an ounce of gold back in March of 1973?

* If you want to know more about gold as an investment, and about how and why the US and other countries left the gold standard, check out this awesome

set of podcasts from

NPR's Planet Money.

** In case it's not clear from my tone here, I don't buy this argument for a second, and when I hear it, I wonder what the person making the claim is trying to sell me (or buy from me). Hint: if they're willing to trade their 'valuable' gold for your 'worthless' dollars... maybe they're not giving you the straight story. Anyway, enough editorializing. Back to the math.

THE SOLUTION

First off, we have to figure out how many months are between March 1975 and May 2017. Quick math reveals that there are 42 years and 2 months between those two points, which is 506 months. First thing first, we make sure the calculator is set to use 12 Payments per Year.

So we enter into the calculator:

N: 506

I/YR: (This is what I'm trying to find)

PV: -178.00

PMT: 0

FV: 1,228.60

Running the calculation, we find out that the return that lump of shiny yellow metal gave us is

4.37% per year. Knowing that, does your opinion of the impressiveness of gold as investment change at all?

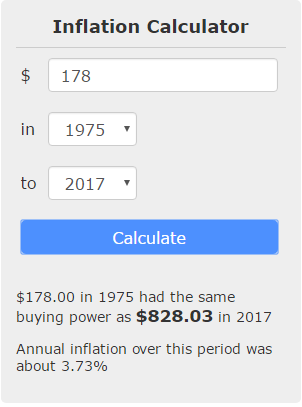

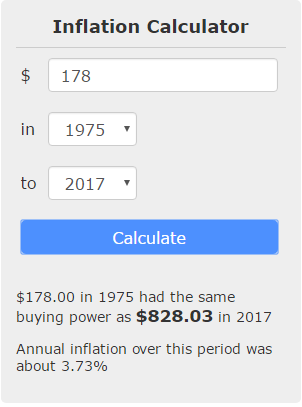

Knowing that inflation between 1975 and 2017 averaged 3.73%, does that change anything?

Anyway, good investing! See you next time!

THE SCENARIO

If you've been [literally anywhere], you've no doubt run across people claiming that gold is the best investment, that the US Dollar (or most other currencies you could name) is a 'fiat currency', and that ever since the US fully went off the Gold Standard in 1971*, our money's been worthless because it's not backed by a metal you have to dig out of the ground... but that metal has real, intrinsic, inherent value.**

But let's say that you had the foresight to buy an ounce of gold long ago, and you wanted to sell it today. How good would your return be?

A quick Internet search reveals that on March 13th 1975, gold was selling for $178.00 per ounce. I was just about to be born at the time, so let's say that my parents bought me an ounce of gold to make me rich when I got older.

On May 14th 2017, it was going for $1,228.60.

If we use monthly compounding, what's your return on investment if you bought an ounce of gold back in March of 1973?

* If you want to know more about gold as an investment, and about how and why the US and other countries left the gold standard, check out this awesome set of podcasts from NPR's Planet Money.

** In case it's not clear from my tone here, I don't buy this argument for a second, and when I hear it, I wonder what the person making the claim is trying to sell me (or buy from me). Hint: if they're willing to trade their 'valuable' gold for your 'worthless' dollars... maybe they're not giving you the straight story. Anyway, enough editorializing. Back to the math.

THE SCENARIO

If you've been [literally anywhere], you've no doubt run across people claiming that gold is the best investment, that the US Dollar (or most other currencies you could name) is a 'fiat currency', and that ever since the US fully went off the Gold Standard in 1971*, our money's been worthless because it's not backed by a metal you have to dig out of the ground... but that metal has real, intrinsic, inherent value.**

But let's say that you had the foresight to buy an ounce of gold long ago, and you wanted to sell it today. How good would your return be?

A quick Internet search reveals that on March 13th 1975, gold was selling for $178.00 per ounce. I was just about to be born at the time, so let's say that my parents bought me an ounce of gold to make me rich when I got older.

On May 14th 2017, it was going for $1,228.60.

If we use monthly compounding, what's your return on investment if you bought an ounce of gold back in March of 1973?

* If you want to know more about gold as an investment, and about how and why the US and other countries left the gold standard, check out this awesome set of podcasts from NPR's Planet Money.

** In case it's not clear from my tone here, I don't buy this argument for a second, and when I hear it, I wonder what the person making the claim is trying to sell me (or buy from me). Hint: if they're willing to trade their 'valuable' gold for your 'worthless' dollars... maybe they're not giving you the straight story. Anyway, enough editorializing. Back to the math.

Anyway, good investing! See you next time!

Anyway, good investing! See you next time!